(Executive summary)

Innovation doesn’t arrive. Innovation evolves.

Imagine it. Freedom from drudgery. Freedom from the toil of tedious, repetitive, mundane, monotonous tasks. Far less time needs to be spent fulfilling the role of "data janitor". Time spent "transaction chasing" is significantly reduced.

Accounting is a well understood system which has evolved over many thousands of years. Accounting, reporting, auditing, and analysis is being digitized. This digitization will enable processes to be industrialized and productivity boosts to be realized.

This overview is an attempt to take the work that I have done to understand XBRL-based reports and back into a framework for explaining those reports, accounting and audit working papers, analysis models to accountants and software engineers building software for accountants. I am now referring to this as model-driven reporting.

The sources of the information provided below are my "lab notebook" from December 2007 to October 2022; my Digital Financial Reporting blog from October 2022 until January 2025; Mastering XBRL-based Digital Financial Reporting; and finally my Seattle Method documentation.

What I have tried to do is take the seemingly hundreds of incomplete, far too technical, typically nonstandard explanations that I have come across; take the best ideas from each, make improvements to those explanations, and resynthesize the information into a form that is useful to me and perhaps useful to other business professionals which have a liberal arts education (i.e. not a technical oriented computer science education). How my conclusions were reached are generally provided via reference to the resources provided above.

Modern accountancy is both inevitable and imminent. However, it is not predetermined. Instead, it will be shaped by the decisions made in the coming years. By making informed choices, we can avoid and prevent undesirable outcomes concerning the needs of business professionals.

It is hoped that this information contributes to making those informed choices.

Narrative

XBRL-based digital financial reporting can improve general purpose financial reporting and other aspects of accountancy. This improvement comes from the fact that such reports can increase mutual understanding of report information thus increasing transparency, make report information truly interpretable by computers and computer based processes, and work can be effectively transformed by enabling computer based processes to take over many tedious, repetitive, mundane, monotonous tasks from accountants which frees up accountants to concentrate on more value added tasks.

Humans can team up with computers, offloading much of the drudgery involved in accounting and dramatically amplifying work capabilities. This is achieved via the effective and precise communication between humans and computers.

Accounting is an area of knowledge. The knowledge within that area of knowledge can be represented in machine interpretable form using a number of different possible knowledge representation approaches. Those different knowledge representation approaches are interchangeable to the extent of the medium of exchange which is able to be represented using each specific representation approach. All this can be implemented within computer software.

Tools provide leverage. Having knowledge in a form which is reliably machine interpretable enables new types of tools to be built.

Financial statements and financial reporting as practiced when using financial reporting frameworks (a.k.a. schemes) such as United States Generally Accepted Accounting Principles (US GAAP), International Financial Reporting Standards (IFRS), Government Accounting Standards in the United States (GAS), International Public Sector Accounting Standards (IPSAS), and other such financial reporting frameworks are not "standardized forms". Rather, such financial reporting frameworks are intended to be, and should be, "customized reports".

Both standardized form based reporting and customized report based financial reporting provide specific capabilities. If a customized report based approach is used, "freeform" or uncontrolled report customizations simply will not work. Rather a "controlled report model" approach must be used in order to keep reports created within the boundaries of a specified report model in order to facilitate both the flexibility necessary for reporting economic entities required by these sorts of financial reporting frameworks and the control necessary to enable effective reporting systems to eliminate "wild behavior" by reporting economic entities; keeping them within the necessary boundaries to facilitate the level of quality necessary to make use of reported information contained in customized report models and reports.

This reality is independent of any physical technical format used to represent the report models and report information.

There tends to be three general approaches to implementing such a problem solving system: (1) the Semantic Web Stack, (2) Labeled Property Graphs (LPG), (3) Logic Programming. There tends to be three global open standard technical formats for representing a business report that fit into those technical format. To represent business reports you need a logical conceptualization and theory of a business report which describes such business reports. Two global open industry standard logical conceptualizations of a business report exist: (1) XBRL Internationals Open Information Model (OIM) and (2) OMG's Standard Business Report Model (SBRM).

The

Seattle Method is based on XBRL and its Open Information Model and the Seattle Method is the basis for the Standard Business Report Model. As such, the

OIM, SBRM, and the Seattle Method are logically aligned. The logic of a business report per the OIM or SBRM can be expressed using other physical technical formats. Regardless of the technical format, the

logic of the information remains the same.

That means the logic of the logical conceptualization of a business report can be bidirectionally transferred between the different

implementation formats. Further, that logic can be converted from the physical technical format to human readable format using that logical model of a business report and the machine readable physical technical format into a human readable format (this is not bidirectional). And finally, a "pixel perfect" human readable representation can also be created by mapping report facts into a human readable format such as Inline XBRL which is a combination of XHTML and XBRL.

Knowledge representations using that logical conceptualization can be passed from an enterprise software application, to another enterprise software application, to an agent, from one agent to another agent.

Sensemaking is the process of determining the deeper meaning or significance or essence of the collective experience for those within an

area of knowledge. My superpower seems to be sensemaking in the area of accounting information systems. My

system of interest was the general purpose financial statement. A financial statement is effectively a

complex message. The complex message is described using a

theory. That theory enables the management of

epistemic risk.

Governance plays a significant role in managing epistemic risk.

However, the capabilities of the Seattle Method and OIM and SBRM are not, and have never been, limited to only financial concepts. The logical conceptualization of a business report relates to "words" and "numbers"; financial information and nonfinancial information. That logical conceptualization has a dimensional model. This makes that logical conceptualization appropriate to many other general areas of business reporting. Financial reporting is simply one special use case of general business reporting. Other types of reports at different levels of granularity can be used to represent transaction information, accounting and audit working papers, financial analysis models. What all these things have in common is the

core pattern, the information block. Think information Lego.

Fundamentally; for a human to exchange information with another human, a human to exchange information with a machine, a machine to exchange information with a human, or a machine to exchange information with another machine; the following must be true: (true information exchange)

For an effective information exchange you need mutual understanding between an information bearer and an information receiver. You need to create a shared cognitive understanding and mutual knowledge that people have when they communicate information to share

meaning. Effective information exchange can lead to a

virtuous cycle.

The

system and

conceptualization needs to be

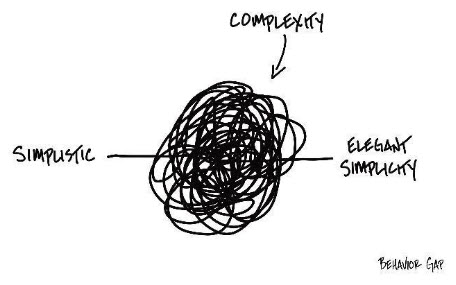

complete to work effectively. If you don't understand the

complexity involved in the system; that complexity cannot be managed. The

epistemic risk, the risk of something going wrong, must be understood and the control variety effectively matched with the perturbance variety to maintain quality.

Humans effectively exchanging information is hard enough. To implement an effective exchange of information between software applications is in some ways harder, but in other ways easier. The

core pattern is to manage information exchange between human and machine teams in a collaborative environment.

Automation can streamline many of the mundane tasks performed by subject matter experts. Artificial intelligence will amplify, augment, and empower these subject matter experts rather than replace them. But the threat of inaccuracy is a real threat which must be mitigated when high-quality information exchanges are required, like for financial reporting.

The payoff in terms of a

productivity boost for accountants and auditors is very real. How work will be performed will change. Effective human-machine teaming will be enabled. The fundamental pattern of work in a work process is summarized in the graphic below and is explained by the

IPO Model:

A new era of human/machine teaming has arrived. Machines will free humans from drudgery and augment the capabilities of humans, amplifying there intelligence. Some task or process currently performed by humans that, if measured, would achieve a sigma level of 3 which is a defect rate of 6.7% (about 67,000 defects per million opportunities) could be improved and could achieve a sigma level of 6 which is a defect rate of 0.00034% (about 4 defects per million opportunities). You are hearing me right, defects go from a whopping 67,000 down to 4.

Seem impossible?

Lean Six Sigma techniques, philosophies, principles, and practices have been around for years, driving operational excellence in many different industries.

Industrial engineers have been making use of Lean Six Sigma for years. This has led to high product quality of manufactured products in many industries. Now Lean Six Sigma can be applied to information processing.

What kind of machine enables these sorts of capabilities?

Knowledge based systems. I like to refer to the machine as a "mindful machine specifically for accountancy". This machine will enable unprecedented levels of human/machine teaming. Humans will perform tasks which they do best and computers will perform tasks which they do best.

BOTTOM LINE: Humans and machines teaming up to perform

work, each bringing what they do best to the table, making processes better, faster, and cheaper is what this is all about. The threat of inaccuracies is reduced; quality goes up. The drudgery of accounting, reporting, auditing, and analysis is reduced.

Automation can streamline many of the mundane tasks performed by accountants, auditors, and analysts. Artificial intelligence will amplify, augment, and empower these financial professionals rather than replace them.

A paradigm shift is occurring. The territory is changing. A new mental map is necessary. Trying to use your old mental map to understand the new territory will be unsatisfying.

This shift is caused by the difference between how "realspace" (the real world, analog) and "cyberspace" (the internet, digital) operate. While many things will stay the same; it is also the case that entirely new business models and products are possible.

Additional Information:

Comments

Post a Comment